Tax A Minute

183 results found

06/06/2025

[Tax A Minute] Stamp Duty Updates: Clarification on Employment Contract

#IncomeTax

#StampDuty

| 06/06/2025 |

[Tax A Minute] Stamp Duty Updates: Clarification on Employment Contract #IncomeTax #StampDuty |

|

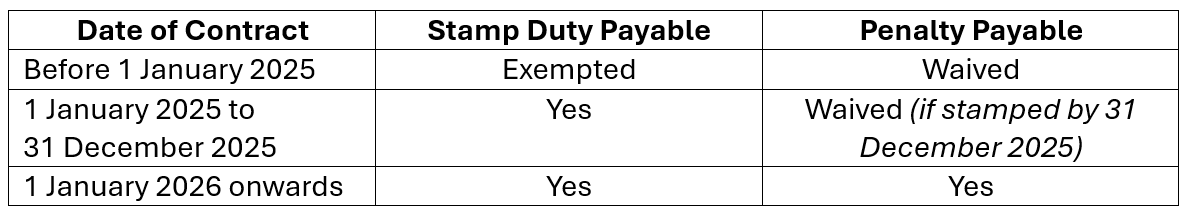

In Budget 2025, the Government announced the phased implementation of the Stamp Duty Self-Assessment System starting from 1 January 2026.

In line with this decision, HASiL introduced the Stamp Duty Audit Framework on 1 January 2025 to explain the audit procedures.

During audit activities carried out by HASiL, a key finding revealed that many employment contracts which should carry a RM10 stamp duty under the Stamp Act 1949 were not stamped.

In response, the following measures were introduced to ease employer compliance and reduce penalties:

Click the link below to find out more!

06/06/2025

[Tax A Minute] e-Invoice Updates: New Implementation Dates and Exemptions

#IncomeTax

#e-Invoice

| 06/06/2025 |

[Tax A Minute] e-Invoice Updates: New Implementation Dates and Exemptions #IncomeTax #e-Invoice |

|

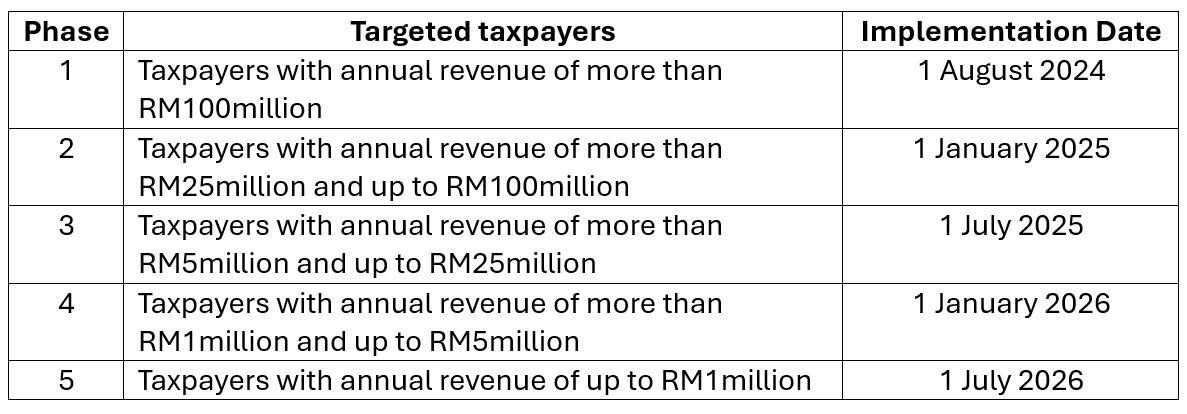

The new implementation timeline for e-Invoice and the new exemption amount is here!

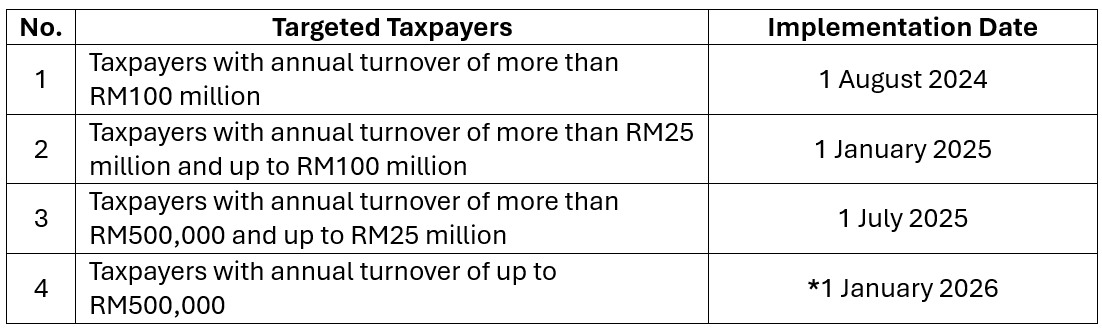

The implementation timeline is shown in the table below:

Note: The 6 months interim relaxation period is still applicable for all the phases.

However, taxpayers with annual revenue of less than RM500,000 are exempted from the implementation of e-Invoice.

Additionally, effective from 1 January 2026, any single transaction with a value exceeding RM10,000 is required to issue an individual e-Invoice for it (consolidated e-Invoice is not allowed)

Please click the link below to find out more!

05/06/2025

⚠️ Scheduled Maintenance Alert: taxPOD Temporary Downtime

| 05/06/2025 |

⚠️ Scheduled Maintenance Alert: taxPOD Temporary Downtime |

|

⚠️ Scheduled Maintenance Alert: taxPOD Temporary Downtime

The platform will be undergoing scheduled maintenance:

📅 7 June (12:00 AM) – 8 June (11:59 PM) | MYT

⏳ It will be temporarily unavailable during this time.

We appreciate your patience and understanding as we work to improve your experience!

30/05/2025

[Tax A Minute] How to Pay for Stamp Duty & How STAMPS System Helps!

#IncomeTax

#StampDuty

| 30/05/2025 |

[Tax A Minute] How to Pay for Stamp Duty & How STAMPS System Helps! #IncomeTax #StampDuty |

|

Starting to hear more about the RM10 stamp duty on employment contracts? You’re not alone!

But here’s the good news: You don’t have to queue at LHDN counters to get it done.

Enter STAMPS – the e-Stamping system by LHDN that allows you to assess and pay stamp duty entirely online.

What is STAMPS?

STAMPS (Stamp Duty Assessment and Payment System) is LHDN’s main platform for e-Stamping. It’s open to:

- Law firms

- Banks

- Insurance companies

- Company / Other registered agents

- Individuals

✅ Apply online

✅ Pay via FPX or selected bank portals

✅ Track your status anytime

Starting from 1 June 2025, any enquiries and feedback regarding the STAMPS system can be submitted via the Customer Feedback Form at link below.

Click the link below to find out more!

27/05/2025

[Tax A Minute] Stamp Duty on Employment Contracts

#IncomeTax

#StampDuty

| 27/05/2025 |

[Tax A Minute] Stamp Duty on Employment Contracts #IncomeTax #StampDuty |

|

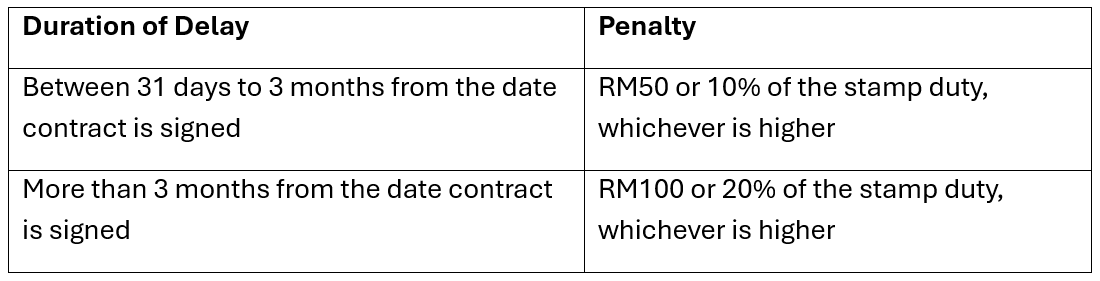

The Stamp Act 1949 requires Employment Contracts to be stamped for a fee of RM10 per copy, payable to the LHDN. The submission for stamping must be completed within 30 days from the signing of contract between parties.

Failure to comply will result in penalty as outlined below:

According to the Stamp Duty Audit Framework effective from 1 January 2025, stamp duty audits are conducted on either a general or a comprehensive basis and may cover up to 3 calendar years. However, the limitation on the audit coverage period does not apply to cases involving fraud, evasion of duty, or negligence.

Click the link below to find out more about Stamp Duty!

21/05/2025

[Tax A Minute] 🚢The First Public Ruling for 2025 is out!

#IncomeTax

#PublicRulingNo.1/2025

| 21/05/2025 |

[Tax A Minute] 🚢The First Public Ruling for 2025 is out! #IncomeTax #PublicRulingNo.1/2025 |

|

The Inland Revenue Board (HASiL) has published Public Ruling 1/2025 - Tax Treatment of Malaysian Ship. This Public Ruling replaces the Public Ruling 10/2012 dated 13 December 2012 (First Edition).

The following are the amendments / additions in the latest Public Ruling:

- Tax treatments on Malaysian Ships which covers up to YA2026

- Clarification of tax treatment on the disposal of Malaysian Ship

- Compliance with Conditions for Annual Verification

Click the link to find out more!

19/05/2025

[Tax A Minute] The Legislation for Individual's Dividend Tax Is Gazetted! 🧮

#IncomeTax

#DividendTax

| 19/05/2025 |

[Tax A Minute] The Legislation for Individual's Dividend Tax Is Gazetted! 🧮 #IncomeTax #DividendTax |

|

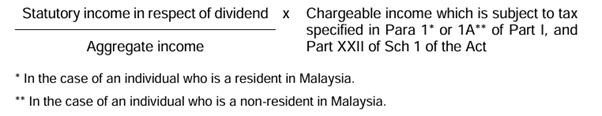

Effective from Year of Assessment 2025, the chargeable income of an individual in respect of dividend which is deemed to be derived from Malaysia is subject to income tax at the specified rate.

Key Highlights:

1. Chargeable Dividend Income: Dividend in excess of RM100,000 which is deemed to be derived from Malaysia.

2. Taxable Person: Both resident and non-resident individuals holding shares directly or through a nominee.

3. Tax Rate: As specified in Schedule 1 of the ITA

Where the individual also has non-dividend income, the chargeable income in item 1 above shall be determined according to the formula below:

Click the link to find out more!

13/05/2025

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in May 2025?

#IncomeTax

| 13/05/2025 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in May 2025? #IncomeTax |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of May 2025:-

✅6th month revision of tax estimates for companies with November year-end

✅9th month revision of tax estimates for companies with August year-end

✅11th month revision of tax estimates for companies with June year-end

✅Statutory filing of 2023 tax returns for companies with October year-end

✅Maintenance of transfer pricing documentation for companies with October year-end

✅ Form BE (Grace period is given until 15 May 2024)

Don’t miss the deadline!

08/05/2025

[Tax A Minute] New Requirement in Form C starting from YA 2025

#IncomeTax

#FormC

| 08/05/2025 |

[Tax A Minute] New Requirement in Form C starting from YA 2025 #IncomeTax #FormC |

|

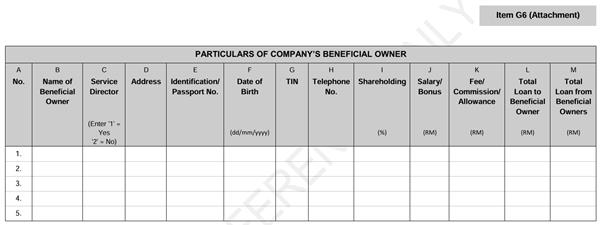

Starting from the Year of Assessment (YA) 2025, taxpayers submitting Form C must complete a new section for "Particulars of Beneficial Owner" as follows:

This addition requires the disclosure of information of the beneficial owner as defined below:

- A natural person who ultimately owns or controls a company through interest in shares and effective interest, including

- An individual who exercises ultimate effective control over the company.

Click the link below to download Sample Form C YA 2025 and find out more about “beneficial owner” in the Guideline issued by the SSM.

05/05/2025

[Tax A Minute] MyInvois e-POS System is coming!

#IncomeTax

#MyInvois

| 05/05/2025 |

[Tax A Minute] MyInvois e-POS System is coming! #IncomeTax #MyInvois |

|

Looking for a simple way to issue e-Invoices? The MyInvois e-POS System by LHDN is a free, digital Point-of-Sale platform tailored for small Malaysian businesses with annual revenue below RM250,000.

✅ Who can use it?

Malaysian citizens running businesses in Malaysia—sole proprietors, partnerships, companies, and more. It’s ideal for retail, F&B, repair services, and others needing inventory features.

🚫 Who can't use it?

Tax agents, intermediaries, or businesses already using a POS system.

📱 What do you need?

An internet connection, a device (PC/tablet/smartphone), and optionally a printer or barcode scanner.

📝 Want early access?

Register as a pilot user by 30 June 2025 to enjoy direct IRBM support and help improve the system.

Click the link below to have the full list of FAQs about the MyInvois e-POS System!

25/04/2025

[Tax A Minute] e-Appointment System for Smoother Tax Services

#IncomeTax

#e-Appointment

| 25/04/2025 |

[Tax A Minute] e-Appointment System for Smoother Tax Services #IncomeTax #e-Appointment |

|

The Inland Revenue Board of Malaysia (HASiL) is stepping up its game in delivering faster, more efficient tax services with the expansion of its e-Appointment System.

Initial Launch:

Introduced on 1 January 2023 to help taxpayers book in-person appointments at HASiL service counters.

Expanded Features (as of 8 March 2024):

Employers can now request offsite counter services, offering more flexibility in tax matters.

New Update (Effective 1 May 2025):

Taxpayers who receive letters or notices via MyTax Portal can:

- Book appointments directly with the officer in charge.

- Choose face-to-face or online sessions, based on convenience.

How to Book:

Go to MyTax Portal > Mailbox > Letter List > Relevant Letter > e-Appointment Icon

Refer to the User Guide in MyTax > User Guide > e-Appointment Manual (Taxpayer)

Click the link below for more information!

15/04/2025

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in April 2025?

#IncomeTax

#StatutoryDeadlines

| 15/04/2025 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in April 2025? #IncomeTax #StatutoryDeadlines |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of April 2025:-

✅6th month revision of tax estimates for companies with October year-end

✅9th month revision of tax estimates for companies with July year-end

✅11th month revision of tax estimates for companies with May year-end

✅Statutory filing of 2023 tax returns for companies with September year-end

✅Maintenance of transfer pricing documentation for companies with September year-end

✅ Form E & CP8D (with grace period)

✅ Form BE

Don’t miss the deadline!

11/04/2025

[Tax A Minute] Expansion of Childcare Allowance Exemption Is Finally Gazetted!

#IncomeTax

#taxexemption

| 11/04/2025 |

[Tax A Minute] Expansion of Childcare Allowance Exemption Is Finally Gazetted! #IncomeTax #taxexemption |

|

With effect from YA 2025, the exemption for childcare allowance (previously) of up to RM3,000 will also cover allowances for elderly care, specifically for parents and grandparents.

The details of the care allowance are:

📅 Effective from: YA2025

💰 Exemption limit: RM3,000 per year

👨👩👧👦 Eligible dependents: Child, parents, adoptive parents and grandparents.

Click the link below for more information!

08/04/2025

[Tax A Minute] 💰 Tariffs Explained: Who Pays the Price?

#IncomeTax

#Tariffs

| 08/04/2025 |

[Tax A Minute] 💰 Tariffs Explained: Who Pays the Price? #IncomeTax #Tariffs |

|

The U.S. has recently imposed new tariffs, and they’re making headlines globally. But what do they really mean for everyday people and businesses? Here’s a quick breakdown:

What are Tariffs?

A tariff is a tax on imported goods, used by governments to regulate trade and protect local industries.

📈 Potential Benefits:

- Boosts demand for locally-made products

- Raises revenue for the government

- Strengthens bargaining power in international negotiations

📉 Possible Downsides:

- Higher prices for imported goods

- Risk of trade wars

- Slower innovation and competition in local industries

Click the link below to check out the Chinese-language video that dives into real-world implications!

02/04/2025

[Tax A Minute] 🚀 MITRS: Submit Your Documents on Time!

#IncomeTax

#MITRS

| 02/04/2025 |

[Tax A Minute] 🚀 MITRS: Submit Your Documents on Time! #IncomeTax #MITRS |

|

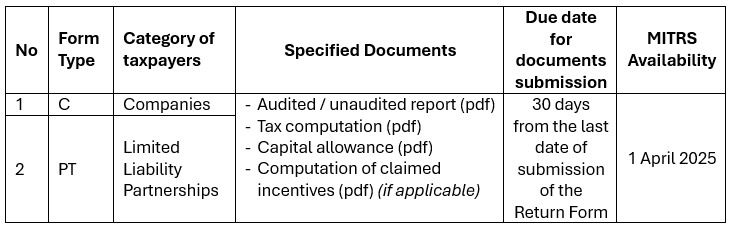

Starting 1 April 2025, taxpayers under Companies (Form C) and Limited Liability Partnerships (Form PT) must submit their required documents through MITRS within 30 days after their tax return due date.

Who Needs to Submit?

✅ Companies (Form C)

✅ Limited Liability Partnerships (Form PT)

Who Can Access MITRS?

👤 Directors

👥 Director Representatives

🧑💼 Tax Agents (TAeF)

How to Submit?

1. Log in to MyTax

2. Go to ezHasil Services

3. Select MITRS

Ensure compliance and avoid penalties - submit on time! ✅

26/03/2025

[Tax A Minute] First Practice Note by HASiL for the Year!

#IncomeTax

#PracticeNoteNo.1/2025

| 26/03/2025 |

[Tax A Minute] First Practice Note by HASiL for the Year! #IncomeTax #PracticeNoteNo.1/2025 |

|

HASiL has published a Practice Note that explains about the tax treatment on the Donations or Contributions received by any ‘person’ including the following:

- Companies

- Body of persons

- Limited liability partnerships (LLP)

- Sole Proprietorships

Donations or contributions received are subject to tax if the receipts:

- have characteristics of income; or

- have elements of badges of trade (e.g. income received repeatedly, etc.).

Click the link below to find out whether your donations received are taxable!

19/03/2025

[Tax A Minute] e-Ansuran is here! 🗣️

#IncomeTax

#MyTax

#e-Ansuran

| 19/03/2025 |

[Tax A Minute] e-Ansuran is here! 🗣️ #IncomeTax #MyTax #e-Ansuran |

|

With effect from 5 March 2025, the e-Ansuran service for online instalment applications to pay outstanding or balance taxes will be available. Taxpayers can apply for instalments and receive automatic approval without submitting any supporting documents.

Eligible Criteria:

- Amount exceeds RM300

- Number of instalments allowed: 2 to 6 payments

- Only applies to income tax payments (including penalties)

- Cannot be used on existing instalments

Taxpayers can access to e-Ansuran in their MyTax Portal. However, do take note that any cancellation of applications can only be done at a HASiL office.

Click the link below to find out more!

17/03/2025

[Tax A Minute] Taxpayers must start submitting specified documents online from 1 Apr 2025? 🤔

#IncomeTax

#MITRS

| 17/03/2025 |

[Tax A Minute] Taxpayers must start submitting specified documents online from 1 Apr 2025? 🤔 #IncomeTax #MITRS |

|

Starting from YA 2025, taxpayers who has furnished a Return Form shall provide information and furnish documents determined by IRBM for ascertaining chargeable income and tax payable as follows:-

Submission of the specified documents through MITRS will be implemented in stages starting with taxpayers of the company category (C) and Limited Liability Partnership (PT).

Notes:

Failure to comply is an offence and shall on conviction, be liable to a fine not less than RM200 and not more than RM20,000 or to imprisonment for a term not exceeding 6 months or both.

Click the link below to find out more!

14/03/2025

[Tax A Minute] 😱 HASiL has released another Tax Audit Framework!

#IncomeTax

#TaxAuditFramework

| 14/03/2025 |

[Tax A Minute] 😱 HASiL has released another Tax Audit Framework! #IncomeTax #TaxAuditFramework |

|

HASiL has published an Tax Audit Framework for Income Tax and Employer, effective from 15 March 2025.

The topics that are included in the framework are as follows:

- Scope of tax audits

- Income tax

- Withholding tax

- Capital gains tax

- Labuan business activities

- Employers audits - Audit coverage period

- Generally, up to 3 years of assessment

- No limit for fraud, wilful default or negligence cases - Case selection for audit

Based on:

- Risk assessment

- Information received from 3rd party

- Industry issues

- Significant controlled transactions - Audit process

- Review of documents at LHDN’s office

- Includes site visits and interviews

- Taxpayers must respond within 14 days to document requests - Rights and responsibilities for:

- LHDN officers

- Taxpayers & employers

- Tax agents - Penalties and offences… and more!

Click the link below to find out more!

10/03/2025

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in March 2025?

#IncomeTax

#TaxFilingDeadline

#StatutoryDeadlines

| 10/03/2025 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in March 2025? #IncomeTax #TaxFilingDeadline #StatutoryDeadlines |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of March 2025:-

✅6th month revision of tax estimates for companies with September year-end

✅9th month revision of tax estimates for companies with June year-end

✅11th month revision of tax estimates for companies with April year-end

✅Statutory filing of 2023 tax returns for companies with August year-end

✅Maintenance of transfer pricing documentation for companies with August year-end

✅ Form E & CP8D

Don’t miss the deadline!

07/03/2025

[Tax A Minute] Are you one of the 66,000 Businesses Caught? 😱

#IncomeTax

#e-Invoice

| 07/03/2025 |

[Tax A Minute] Are you one of the 66,000 Businesses Caught? 😱 #IncomeTax #e-Invoice |

|

Due to the implementation of e-Invoice, HASiL has successfully identified 66,000 businesses on e-commerce platforms that do not comply with estimated tax instalment payments or submit income tax return forms. Hence, businesses are urged to update their tax records to avoid enforcement actions.

As of 3 March 2025, 196 million e-Invoices have been issued, including voluntary participation from third-phase taxpayers.

Please be reminded that the grace period for first-phase taxpayers has ended on 31 January 2025, and full compliance with e-invoice guidelines is now mandatory effective from 1 Feb 2025!

Click the link for more info.

06/03/2025

[Tax A Minute] LHDN Office’s Working Hours During Ramadan

#IncomeTax

#OperatingHours

| 06/03/2025 |

[Tax A Minute] LHDN Office’s Working Hours During Ramadan #IncomeTax #OperatingHours |

|

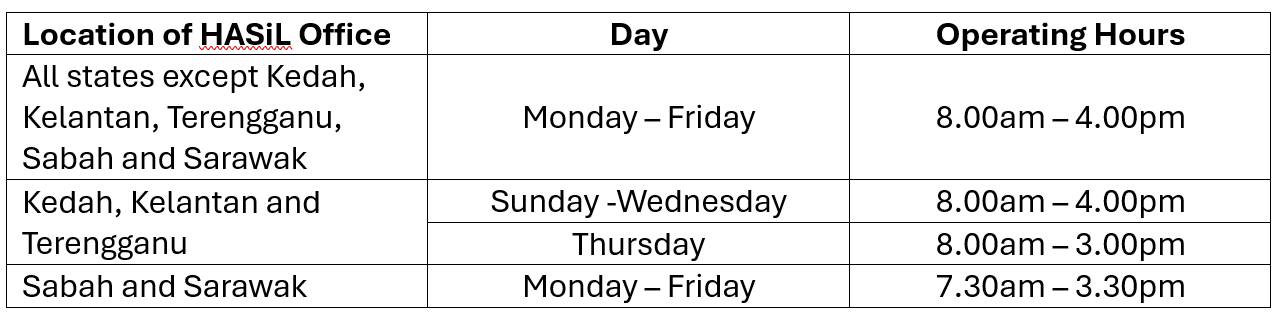

The Operating Hours for the HASiL’s service counters during the month of Ramadan is as follows:

Alternatively, taxpayers can also interact with HASiL through the e-Services provided online via the MyTax portal service gateway by visiting www.hasil.gov.my

Click the link below to check the operating hours for the following:

- HASiL Contact Centre (HCC)

- Pusat Pengurusan Terimaan HASiL (PPTH)

- Pusat Transformasi Bandar (UTC)

03/03/2025

[Tax A Minute] Forms are available to download now!

#IncomeTax

#TaxFilingDeadline

#Submission

| 03/03/2025 |

[Tax A Minute] Forms are available to download now! #IncomeTax #TaxFilingDeadline #Submission |

|

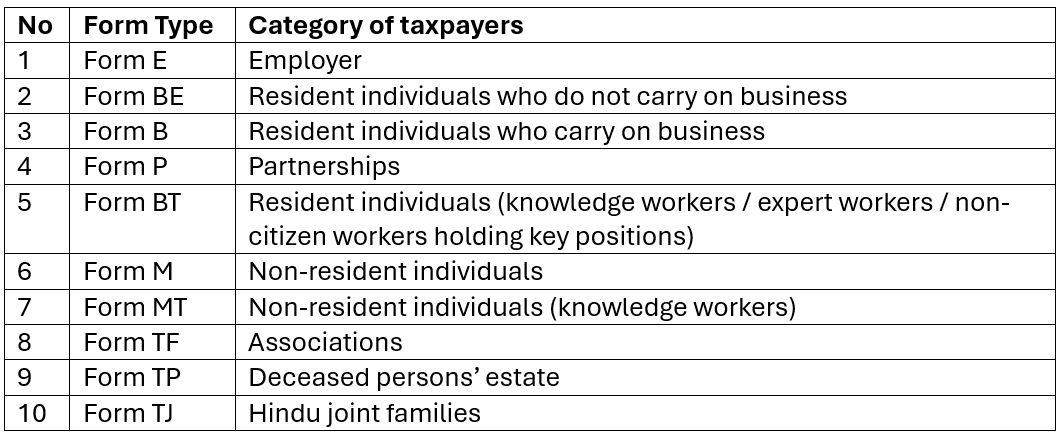

Reminders to taxpayers! The income tax return forms below are available for download now:

Form BE

- For resident individuals without business income (e.g. salaries employee)

- Only for non-business income (e.g. salary, rental)

- Must submit it to the IRB on or before 30 April 2025

Form B

- For resident individuals with business income (e.g. sole props, freelancers)

- For both business and non-business income (e.g. business income, rental)

- Must submit it to the IRB on or before 30 June 2025

Form P

- For partnerships (not individuals)

- Declares partnership income

- Must submit it to the IRB on or before 30 June 2025

The following forms are available to download too!

- Form BT

- Form M

- Form MT

- Form TF

- Form TP

- Form TJ

Click the link below to download the forms!

28/02/2025

[Tax A Minute] Get Ready for e-Filing!

#IncomeTax

#e-Filing

| 28/02/2025 |

[Tax A Minute] Get Ready for e-Filing! #IncomeTax #e-Filing |

|

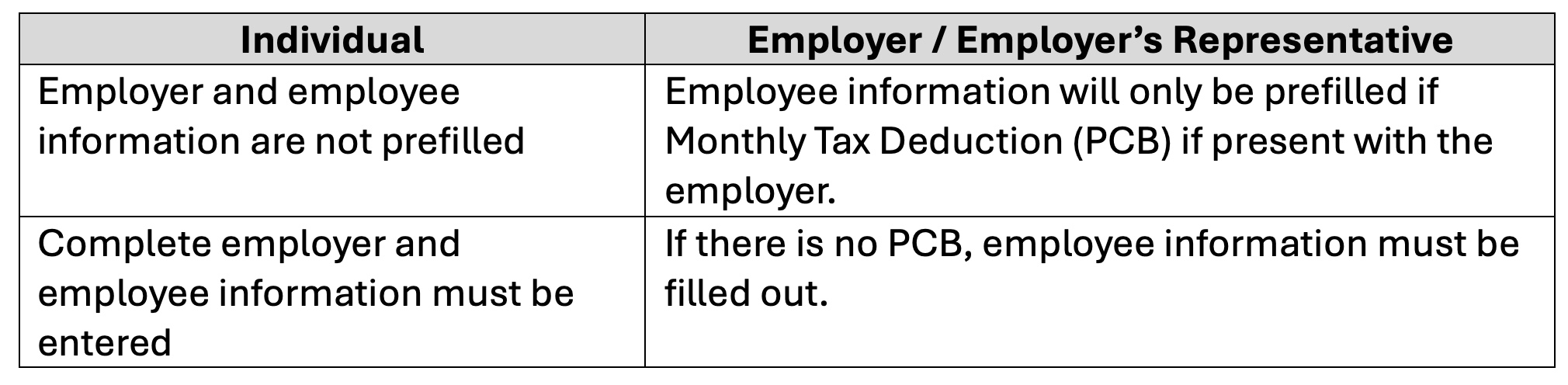

Get ready taxpayers! On 1 March 2025, e-filing will be made available to taxpayers in the categories below:

Click the link below to proceed with the e-filing!

25/02/2025

[Tax A Minute] The new e-Invoice FAQs is here!

#IncomeTax

#e-Invoice

#FAQs

| 25/02/2025 |

[Tax A Minute] The new e-Invoice FAQs is here! #IncomeTax #e-Invoice #FAQs |

|

HASiL has published an updated e-Invoice General Frequently Asked Questions (FAQs) to resolve taxpayers’ most common questions as per the latest update on 21 February 2025, the updates include:

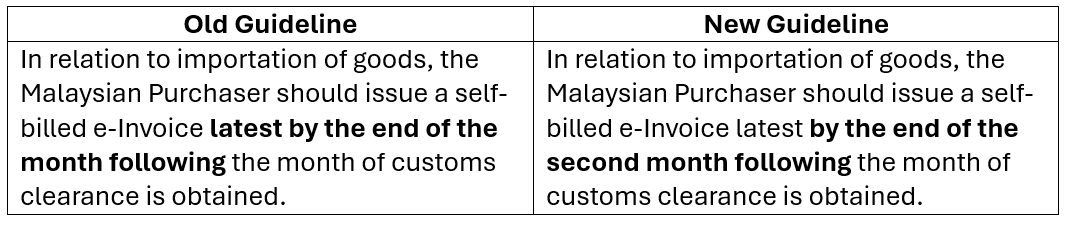

- The e-invoice implementation date for taxpayers with annual turnover up to RM500,000.

- The due date for submission of self-billed e-Invoice for importation of goods.

Click the link to have these questions answered!

24/02/2025

[Tax A Minute] New e-Invoice Guidelines are here!

#IncomeTax

#e-Invoice

| 24/02/2025 |

[Tax A Minute] New e-Invoice Guidelines are here! #IncomeTax #e-Invoice |

|

The HASiL has published the latest e-Invoice guidelines as below:

- e-Invoice General Guideline (dated 21 February 2025)

- e-Invoice Specific Guideline (dated 21 February 2025)

The changes include:

1️⃣ The e-Invoice implementation date as follows:

*6-month interim relaxation period is 1 January 2026 to 30 June 2026

For new businesses or operations commencing from the year 2023 to 2024 with an annual turnover or revenue of

- more than RM500,000, the e-Invoice implementation date is 1 July 2025.

- up to RM500,000, the e-Invoice implementation date is 1 January 2026.

For new businesses or operations commencing from year 2025 onwards, the e-Invoice implementation date is 1 January 2026 or upon the operation commencement date.

2️⃣ Due date on the issuance of self-billed e-Invoice on imported goods

Click the link to find out more!

21/02/2025

[Tax A Minute] Latest news on e-Invoice implementation timeline! 👀

#IncomeTax

#e-Invoice

| 21/02/2025 |

[Tax A Minute] Latest news on e-Invoice implementation timeline! 👀 #IncomeTax #e-Invoice |

|

The government has announced that MSMEs with annual sales between RM150,000 to RM500,000 will postpone their e-Invoice implementation date to 1 Jan 2026!

Hence the new timeline:

Phase 1 (1 Aug 2024): Businesses with annual turnover exceeding RM100mil.

Phase 2 (1 Jan 2025): Businesses with annual turnover exceeding RM25mil up to RM100mil.

Phase 3 (1 Jul 2025): Businesses with annual turnover exceeding RM500k up to RM25mil.

Phase 4 (1 Jan 2026): Businesses with annual turnover between RM150k to RM500k.

Exemption: Businesses with annual turnover of less than RM150k.

18/02/2025

[Tax A Minute] The 9th Self-Billed e-Invoice Scenario!

#IncomeTax

#e-Invoice

| 18/02/2025 |

[Tax A Minute] The 9th Self-Billed e-Invoice Scenario! #IncomeTax #e-Invoice |

|

According to the latest e-Invoice guidelines that were published on 28 January 2025, one of the changes is the addition of scenario for self-billed e-Invoice:

1. Payment to agents, dealers, distributors

2. Goods sold or services rendered by foreign suppliers

3. Profit distribution (e.g. dividend distribution)

4. Electronic commerce (e-commerce) transaction

5. Pay-out to betting and gaming winners

6. Transactions with individuals who are not conducting a business

7. Interest payments (with certain exceptions)

8. Claim, compensation or benefit payments from the insurance business of an insurer

9. Payment in relation to capital reduction, share / capital / unit redemption, share buyback, return of capital or liquidation proceeds.

Timing of issuance:

- If there is a written agreement:

a. If no approval is required from the government or state government, the date of issuance.

b. If approval is required from the government or statement government, the date of issuance will be the date of such approval, or if the approval is conditional, the date of issuance will be the date in which the last condition is satisfied.

- If there is no written agreement: Date of completion

Want to know more about the other changes on the latest e-Invoice Guideline?

Click the link below to watch the February 2025 Monthly Tax Update Class to find out more!

10/02/2025

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in February 2025?

#IncomeTax

#StatutoryDeadlines

| 10/02/2025 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in February 2025? #IncomeTax #StatutoryDeadlines |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of February 2025:-

✅6th month revision of tax estimates for companies with August year-end

✅9th month revision of tax estimates for companies with May year-end

✅11th month revision of tax estimates for companies with March year-end

✅Statutory filing of 2023 tax returns for companies with July year-end

✅Maintenance of transfer pricing documentation for companies with July year-end

✅EA Forms (deadline for employers to prepare EA Forms for their employees)

Don’t miss the deadline!

10/02/2025

[Tax A Minute] e-Invoice Industry Specific FAQ got updated!

#IncomeTax

#e-Invoice

#FAQs

| 10/02/2025 |

[Tax A Minute] e-Invoice Industry Specific FAQ got updated! #IncomeTax #e-Invoice #FAQs |

|

HASiL has published an updated version for the e-Invoice Industry Specific FAQ dated 28 January 2025 to include the following e-Invoice treatment:

a. Insurance and Takaful Industry

- Reinsurance service and recoveries of expenses

- Self-billing on recoupment of claim

- Malaysian Insurance Pool (MMIP)

b. Financial Services, Stockbroking and Unit Trust

- Interest rate swap

- Issuance or transfer of unquoted securities or derivatives

Please click the link below to find out more!

04/02/2025

[Tax A Minute] ❗e-PCB Plus is fully operational❗

#IncomeTax

#e-PCBPlus

| 04/02/2025 |

[Tax A Minute] ❗e-PCB Plus is fully operational❗ #IncomeTax #e-PCBPlus |

|

Starting from 3 February 2025, the e-PCB Plus system is fully operational, it’s capable of:

- Make PCB payment

- Check payment status

- View payment history

The e-PCB Plus System is accessible through MyTax Portal, where users can act as:

- Employers

- Employer representatives (can be appointed via MyTax Portal)

- PCB administrators (can be appointed via MyTax Portal)

- Administrator representatives

Please ensure that PCB submission / upload and verification are completed before proceeding with payment.

04/02/2025

[Tax A Minute] Preparation of Form E and EA

#IncomeTax

#FormEA

#FormE

| 04/02/2025 |

[Tax A Minute] Preparation of Form E and EA #IncomeTax #FormEA #FormE |

|

Reminder on employers’ responsibility: Form E and Form EA are here! 👀

Form E

- This form provides a summary of all employees’ income details.

- Submit return form of employer (Form E) together with the C.P.8D via online.

- Must submit it to the IRB on or before 31 March 2025.

Form EA / EC

- A Statement of remuneration (Form EA / EC) in respect of the employees.

- Must be provided to employees by 28 February 2025.

- Employees will submit their personal income tax return form based on the From EA / EC received.

The forms can be downloaded through:

HASiL website > Download Form > Employer > Year 2024

03/02/2025

[Tax A Minute] The e-Invoice Guidelines are updated again as of 28 January 2025!

#IncomeTax

#e-Invoice

| 03/02/2025 |

[Tax A Minute] The e-Invoice Guidelines are updated again as of 28 January 2025! #IncomeTax #e-Invoice |

|

The HASiL has updated the following guidelines:

- e-Invoice General Guidelines (updated on 28 January 2025)

- e-Invoice Specific Guidelines (updated on 28 January 2025)

- e-Invoice General FAQs (updated on 28 January 2025)

The above updates provide clarifications on the following matters:

1. Added the list of International Organisations

2. Added circumstances for issuance of consolidated self-billed e-Invoices

3. Amendment on circumstances requiring issuance of self-billed e-Invoices

4. E-Invoice treatment for:

- Special Purpose Vehicle (SPV)

- Businesses commencing from 2023 onwards

- Corporate agents

- Import duty and sales tax levy (importation of goods)

Please Click the link below to find out more!

22/01/2025

[Tax A Minute] 😱3 New Audit Frameworks are here!

#IncomeTax

#TaxAudit

#TaxAuditFramework

| 22/01/2025 |

[Tax A Minute] 😱3 New Audit Frameworks are here! #IncomeTax #TaxAudit #TaxAuditFramework |

|

HASiL has released 3 of the following audit frameworks:

1️⃣Transfer Pricing Tax Audit Framework

- Ensure compliance with the arm’s length principle in a controlled transaction.

- Ensure compliance with Malaysian tax laws as well as other regulations issued by IRBM.

- Ensure voluntary compliance with the tax laws and regulations and tax compliance can be achieved under the SAS.

2️⃣Real Property Gains Tax Audit Framework

- To encourage voluntary compliance with the RPGT Act 1976, in line with the implementation of the Self-Assessment System for RPGT.

- To educate and raise awareness among taxpayers about their responsibilities and obligations under the RPGT Act 1976.

- RPGT audit officers must ensure that proper disposals are reported, and taxes are paid in compliance with the RPGT Act 1976.

3️⃣Stamp Duty Audit Framework

- To encourage voluntary compliance with the Stamp Act 1949. Audit officers must ensure that the stamping performed is accurate and complies with the legal provisions.

- This stamp duty audit framework outlines the legal provisions applied by IRB when conducting audits, as well as the rights and responsibilities of the auditee.

- Stamp duty audit activities are an approach by the IRBM to educate and raise awareness among auditees about their responsibilities and obligations under the Stamp Act 1949.

Please click the link below to find out more!

17/01/2025

[Tax A Minute] 🏠The RPGT Operational Guideline is here!

#IncomeTax

#RPGT

| 17/01/2025 |

[Tax A Minute] 🏠The RPGT Operational Guideline is here! #IncomeTax #RPGT |

|

The 2025 RPGT Operational Guideline introduces the Self-Assessment System and mandates digital compliance through the e-CKHT system on the MyTax portal. Key highlights:

- e-Filing:

All RPGT return form submission must be done electronically. Paper submissions are no longer accepted. - Responsibilities:

Disposers: File forms (CKHT 1A, 1B, or 3) within 60 days of disposal and pay taxes within 90 days. Maintain records for 7 years.

Acquirers: File CKHT 2A within 60 days, withhold 3%, 5%, or 7% of the consideration based on disposer category, and remit the amount to LHDNM. - Payments:

Use ByrHasil FPX or HASiL's agent banks for payments. Payment deadlines are 60 days for acquirers and 90 days for disposers.

Click below to find out more!

14/01/2025

[Tax A Minute] 😱Public Ruling No. 7/2024 is here!

#IncomeTax

#PublicRulingNo.7/2024

| 14/01/2025 |

[Tax A Minute] 😱Public Ruling No. 7/2024 is here! #IncomeTax #PublicRulingNo.7/2024 |

|

HASiL has published Public Ruling No. 7/2024: Co-operative Society, replacing the previous Public Ruling No. 9/2011 dated 16 Nov 2011.

The updates and amendments in the Public Ruling include:

- Interpretation of Co-operative Principles

- Tax treatment of Co-operative Society

- Tax incentives for Approved Food Production Project

- Tax incentives for the East Coast Economic Region

Please click the link below to find out more!

13/01/2025

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in January 2025?

#IncomeTax

#TaxFilingDeadline

| 13/01/2025 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in January 2025? #IncomeTax #TaxFilingDeadline |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of January 2025:-

✅6th month revision of tax estimates for companies with July year-end

✅9th month revision of tax estimates for companies with April year-end

✅11th month revision of tax estimates for companies with February year-end

✅Statutory filing of 2023 tax returns for companies with June year-end

✅Maintenance of transfer pricing documentation for companies with June year-end

Don’t miss the deadline!

10/01/2025

[Tax A Minute] ✨New Public Rulings are out!

#PublicRulingNo.4/2024

#PublicRulingNo.5/2024

#PublicRulingNo.6/2024

| 10/01/2025 |

[Tax A Minute] ✨New Public Rulings are out! #PublicRulingNo.4/2024 #PublicRulingNo.5/2024 #PublicRulingNo.6/2024 |

|

The Inland Revenue Board (HASiL) has published three of the following Public Rulings:

- Public Ruling 4/2024: Taxation of a Resident Individual Part 1 – Gifts or Contributions and Allowable Deductions

- Tax deductions that are allowable in computing his chargeable income. - Public Ruling 5/2024: Tax Incentive for Investment in Bionexus Status Company

- Tax incentives offered to an investor who has invested in a BioNexus status company (BSC) in Malaysia. - Public Ruling 6/2024: Tax Incentive for Organizing Arts, Cultural, Sports and Recreational Activities

- Tax incentives available to a promoter that organizes an approved art or cultural activities as well as sports or recreational competitions in Malaysia.

Please click the link below to find out more!

08/01/2025

[Tax A Minute] ❗e-PCB, e-CP39 and e-Data PCB Closing Soon❗

#IncomeTax

#PCB

#e-PCB

#e-PCBPlus

#e-CP39

#e-DataPCB

| 08/01/2025 |

[Tax A Minute] ❗e-PCB, e-CP39 and e-Data PCB Closing Soon❗ #IncomeTax #PCB #e-PCB #e-PCBPlus #e-CP39 #e-DataPCB |

|

Kindly be informed that the final submission date for data and payment for Monthly Tax Deduction (MTD) is 15 January 2025 for the platforms below:

- e-PCB

- e-CP39

- e-Data PCB

Employers / users are advised to complete all submission and payment processes before or by this date.

After this date, the functions will be completely deactivated, employers will only have limited access to the system for review purposes, which will be available within a specified period.

Employers / users are requested to take appropriate actions to facilitate a smooth transition to the e-PCB Plus system, which is expected to launch by the end of January 2025.

Please click the link below for more information!

07/01/2025

[Tax A Minute] 🔎TIN Search Function is here!

#IncomeTax

#e-Invoice

#TIN

| 07/01/2025 |

[Tax A Minute] 🔎TIN Search Function is here! #IncomeTax #e-Invoice #TIN |

|

The Tax Identification Number (TIN) search platform is accessible from 1 January 2025 via the MyTax Portal by selecting the “TIN Search” menu. Taxpayers can perform TIN searches by providing information based on the following categories:

- Individuals: Identification Number (IC Number/ Passport Number)

- Non-individuals: Business Registration Number (BRN) or the Taxpayer’s Name registered with HASiL for entities without a BRN.

Kindly be advised that the TIN search function is strictly for purposes under ITA 1967, any misuse of this function may result in prosecution.

Please click the link below for more information!

27/12/2024

[Tax A Minute] Service Tax Policy 8/2024 is here!

#IncomeTax

#ServiceTax

| 27/12/2024 |

[Tax A Minute] Service Tax Policy 8/2024 is here! #IncomeTax #ServiceTax |

|

The Royal Malaysian Customs Department (RMCD) has published the Service Tax Policy 8/2024, granting an exemption from service tax on fees or commissions for local commodity trading platforms.

The details are as follows:

- Applicable only for Islamic financial transactions on local commodity trading platforms

- Effective 1 October 2024

Click the link below to find out more!

27/12/2024

[Tax A Minute] Return Form (RF) Filing Programme for the Year 2025 is Here! 📅

#IncomeTax

#2025returnformfilingprogramme

| 27/12/2024 |

[Tax A Minute] Return Form (RF) Filing Programme for the Year 2025 is Here! 📅 #IncomeTax #2025returnformfilingprogramme |

|

The Inland Revenue Board of Malaysia (HASiL) has published the Return Form (RF) Filing Programme for the Year 2025 on the HASiL Portal. Taxpayers can use the 2025 Filing Programme as a reference and submission guide to file their tax returns as it consists of various tax filing deadlines and grace periods.

Click the link below to find out more!

26/12/2024

[Tax A Minute] ✅Application Date Extended for Green Technology Incentive - Solar Photovoltaic System Leasing!

#IncomeTax

#TaxIncentiveScheme

#TaxIncentive

#GovernmentIncentives

| 26/12/2024 |

[Tax A Minute] ✅Application Date Extended for Green Technology Incentive - Solar Photovoltaic System Leasing! #IncomeTax #TaxIncentiveScheme #TaxIncentive #GovernmentIncentives |

|

The legislation for Green Technology Incentive (Solar Photovoltaic System Leasing) has been updated as follows:

- Original Deadline: Applications must be received by 31 December 2023.

- Extended Deadline: The deadline is now 31 December 2026, allowing more companies to benefit.

Notes:

1. Exemption: 70% of statutory income derived from qualifying activity.

2. Qualifying Activity: Providing solar photovoltaic system leasing services by any qualifying company in relation to the implementation of Net Energy Metering Scheme for sales of electricity or solar photovoltaic system leasing.

3. Qualifying Company:

- Incorporated and resident in Malaysia with at least 60% directly owned by Malaysian citizens.

- Services verified by the Sustainable Energy Development Authority Malaysia (SEDA).

- Listed in the Registered Solar Photovoltaic Investor Directory.

Click the link below to find out more!

24/12/2024

[Tax A Minute] 🏅Athletes’ Prize Monies are Exempted from Tax

#IncomeTax

| 24/12/2024 |

[Tax A Minute] 🏅Athletes’ Prize Monies are Exempted from Tax #IncomeTax |

|

With effect from YA 2024, the Minister exempts an athlete from the payment of income tax on the amount of the prize money received from the Federal Government through the National Sports Council of Malaysia under the Sports Victory Prize Scheme.

Click the link below for more information!

23/12/2024

[Tax A Minute] 🚫Access to e-Forms for YA 2016 and 2017 are closing soon!

#IncomeTax

#e-Filing

| 23/12/2024 |

[Tax A Minute] 🚫Access to e-Forms for YA 2016 and 2017 are closing soon! #IncomeTax #e-Filing |

|

Starting from 1 January 2025, e-Forms for Year of Assessment (YA) 2016 and 2017 will be no longer accessible by all taxpayers.

The Inland Revenue Board (HASiL) will only provide e-Filing facilities for 7 years and will close access to e-Forms for the last YA on 31 December each year.

Any submission of forms after the timeframe must be done using paper Return Forms manually which can be downloaded from the official HASiL portal.

Please click the link below for more information!

19/12/2024

[Tax A Minute] 🗓️ SVDP 2.0 - Make Full Payment by 31 Dec 2024!

#IncomeTax

#SVDP2.0

| 19/12/2024 |

[Tax A Minute] 🗓️ SVDP 2.0 - Make Full Payment by 31 Dec 2024! #IncomeTax #SVDP2.0 |

|

Taxpayers who have participated in the Voluntary Disclosure Programme 2.0 are urged to make full payment according to the agreed instalment schedule by or before 31 December 2024. Failure to do so may result in late payment penalties or legal action in court.

❗Note: Non-compliance may lead to tax audits or investigations too!

Click the link below to find out more.

18/12/2024

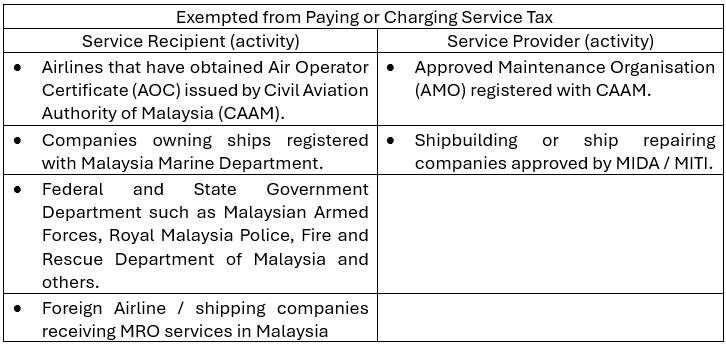

[Tax A Minute] ⚓Service Tax Policy 6/2024 has been amended!

#IncomeTax

#ServiceTax

| 18/12/2024 |

[Tax A Minute] ⚓Service Tax Policy 6/2024 has been amended! #IncomeTax #ServiceTax |

|

The policy includes editorial amendments to improve sentence clarity. Some key amendments are as follows:

Note: For foreign airline / shipping companies receiving MRO services in Malaysia, any equipment or components imported from overseas and involved in MRO activities conducted in Malaysia must be re-exported from Malaysia and are subject to the conditions set by the RMCD.

Click the link below to learn more!

17/12/2024

[Tax A Minute] 💸15% deduction from HRDC unused levy balance

#IncomeTax

#HRDCorp

| 17/12/2024 |

[Tax A Minute] 💸15% deduction from HRDC unused levy balance #IncomeTax #HRDCorp |

|

Employers who meet the following criteria will be subjected to a 15% deduction from their unused levy in 2024:

1. Unused levy balance of RM50,000 and above for 2024 only; and

2. Levy utilisation rate of less than 50% from the contribution from 1 January 2024 to 31 December 2024.

The implementation of the above deduction is effective 1 January 2025. However, employers are given a 2 months grace period from 1 January 2025 to 28 February 2025 to utilise their levy contribution to more than 50% for the year 2024 for training purposes.

The 15% deduction will commence on 1 March 2025, for all affected employers.

Please click the link below to get more details! 👇

16/12/2024

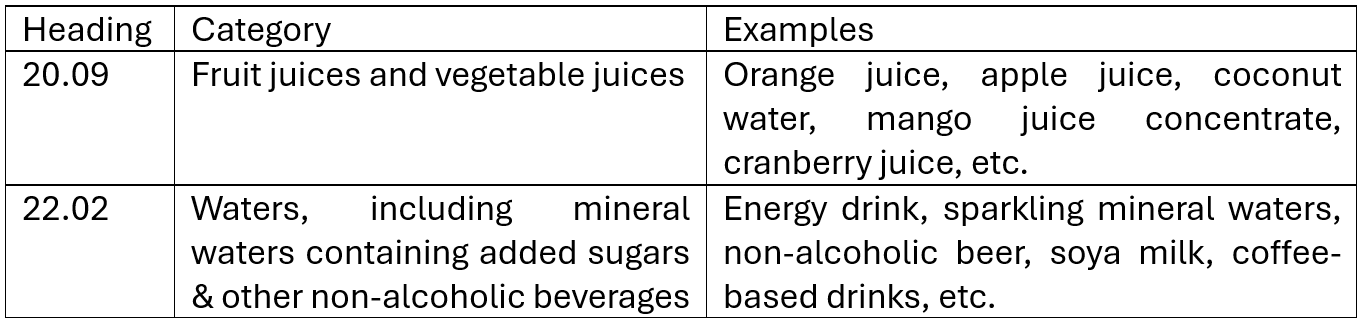

[Tax A Minute] 📈 Increased rate of excise duty for sugar-sweetened beverages❗

#IncomeTax

#Budget2025

| 16/12/2024 |

[Tax A Minute] 📈 Increased rate of excise duty for sugar-sweetened beverages❗ #IncomeTax #Budget2025 |

|

The increase on excise duty on sugar-sweetened beverages as mentioned in the Budget 2025 announcement has been gazetted.

With effect from 1 January 2025, excise duties will be increased from RM0.50 per litre to RM0.90 per litre for the beverages below:

Click the link below for more information!

13/12/2024

[Tax A Minute] Global Minimum Tax? Check it out to see if you hit the requirements!

#IncomeTax

#GlobalMinimumTax

#GMT

| 13/12/2024 |

[Tax A Minute] Global Minimum Tax? Check it out to see if you hit the requirements! #IncomeTax #GlobalMinimumTax #GMT |

|

Effective from 1 January 2025, companies are required to file a prescribed form for Global Minimum Tax (GMT) if they fulfil the criteria below:

⭕Taxpayer is an MNE Group

⭕MNE Group with annual revenue of EUR 750 million or more in at least two of the four previous years.

Please click the link below for more information!

12/12/2024

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in December 2024?

#IncomeTax

#TaxFilingDeadline

#StatutoryDeadlines

| 12/12/2024 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in December 2024? #IncomeTax #TaxFilingDeadline #StatutoryDeadlines |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of December 2024:-

✅6th month revision of tax estimates for companies with June year-end

✅9th month revision of tax estimates for companies with March year-end

✅11th month revision of tax estimates for companies with January year-end

✅Statutory filing of 2023 tax returns for companies with May year-end

✅Maintenance of transfer pricing documentation for companies with May year-end

✅Small value WHT (payments made to NR between 1 June 2024 to 30 November 2024)

Don’t miss the deadline!

11/12/2024

[Tax A Minute] An Updated Public Ruling is here!

#IncomeTax

#PublicRulingNo.3/2024

| 11/12/2024 |

[Tax A Minute] An Updated Public Ruling is here! #IncomeTax #PublicRulingNo.3/2024 |

|

The Public Ruling 3/2024 – Tax Borne by Employers is updated with the following:

1️⃣Para 4: Updated illustration for basis period to which employment income is received,

2️⃣Para 6: Examples 1, 2, 3, 4, 5, 6, 7 and 8 are amended as follows (whichever applies):

- Dates are amended to the latest year

- Amount of individual tax relief is amended to the latest amount

- Tax rates are amended according to the latest YA

- Penalty rate is amended to the latest penalty rate

- Latest Public Ruling number

3️⃣Para 7: Updated explanation on Monthly Tax Deduction (MTD), and

4️⃣Para 9: Expansion and tabulation on Responsibility of Employers.

This Public Ruling replaces Public Ruling 11/2016 dated 8 December 2016.

Click the link below for more information!

10/12/2024

[Tax A Minute] Clarification Regarding Service Tax Exemption for Golf Club and Golf Driving Range Operators ⛳

#IncomeTax

#ServiceTax

| 10/12/2024 |

[Tax A Minute] Clarification Regarding Service Tax Exemption for Golf Club and Golf Driving Range Operators ⛳ #IncomeTax #ServiceTax |

|

The Customs wishes to clarify the following:

✅Preparation of food and beverage or catering services provided by golf club and golf driving range operators remain subject to a 6% service tax.

❌Processed and packaged food products such as crackers, biscuits, and candies sold by golf club or golf driving range operators are not subject to service tax starting 27 November 2024.

Click below to find out more!

06/12/2024

[Tax A Minute] Minimum Wages Rate of RM1,700 Has Been Gazetted!

#IncomeTax

#Budget2025

| 06/12/2024 |

[Tax A Minute] Minimum Wages Rate of RM1,700 Has Been Gazetted! #IncomeTax #Budget2025 |

|

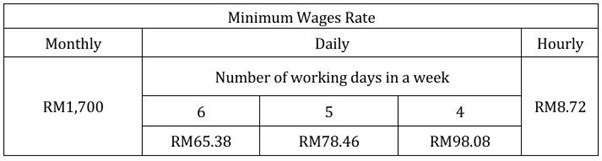

(i) Employer who employs 5 or more employees / employer who carries professional activity

Minimum wages rate with effect from 1 February 2025 shall be as follows:-

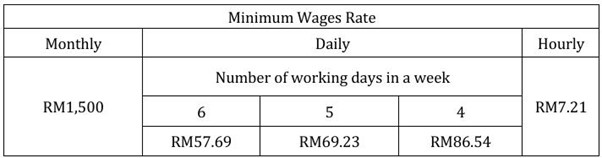

(ii) Employer who employs less than 5 employees other than employer who carries professional activity

Minimum wages rate with effect from 1 February 2025 to 31 July 2025 shall be as follows:-

Minimum wages rate with effect from 1 August 2025 shall be as follows:-

Click the link for more information!

05/12/2024

[Tax A Minute] Submission of Information and Documents to the HASiL

#IncomeTax

#2025

| 05/12/2024 |

[Tax A Minute] Submission of Information and Documents to the HASiL #IncomeTax #2025 |

|

Taxpayers who have furnished their Return Form shall provide information and furnish documents determined by the Inland Revenue Board (HASiL) within 30 days after the due date for submission of the Return Form.

Starting from YA 2025, submission of the information and specified documents through Malaysian Income Tax Reporting System (MITRS) will be implemented in stages starting with taxpayers as follows:

⭕ Company (C)

⭕ Limited Liability Partnership (PT)

Click the link below to check the Information and Furnished Documents required!

03/12/2024

[Tax A Minute] RMCD - Issuance of Compliance Verification Audit Framework (AViP)

#IncomeTax

#TaxAudit

#AViP

| 03/12/2024 |

[Tax A Minute] RMCD - Issuance of Compliance Verification Audit Framework (AViP) #IncomeTax #TaxAudit #AViP |

|

RMCD issued the AViP Framework as a guide for business entities on the implementation of AViP audits, helping them understand its objectives and direction.

The advantages of voluntarily participating in the AViP include the following:

- 100% penalty remission if payment is made within six months from the date of disclosure.

- 50% penalty remission if payment is made after six months but within twelve months from the date of disclosure.

- Option to pay the bill of demand in installments.

This framework aims to enhance business compliance in line with the laws, procedures, and tax policies administered by the RMCD.

Click the link for more information!

28/11/2024

[Tax A Minute] Service Tax Regulations 2024 Has Been Amended!

#IncomeTax

#ServiceTax

#TaxAmendments

| 28/11/2024 |

[Tax A Minute] Service Tax Regulations 2024 Has Been Amended! #IncomeTax #ServiceTax #TaxAmendments |

|

The amendment on the Service Tax Regulations (Amendment) (No. 2) Regulations 2024 are as follows:

a) Group relief has been expanded to include maintenance or repair services provided within the same group of companies

b) Registered practitioners providing traditional and complementary medicine services are excluded from being taxable persons for service tax

c) Golf club and golf driving range - the provision or sale of food is no longer a taxable service for service tax

d) Maintenance or repair services for goods and equipment fixed to the structure of a residential house are excluded from being taxable services for service tax

Click the link below for more information!

26/11/2024

[Tax A Minute] RPGT must be submitted online via e-CKHT through the MyTax Portal

#IncomeTax

#RPGT

#CKHT

| 26/11/2024 |

[Tax A Minute] RPGT must be submitted online via e-CKHT through the MyTax Portal #IncomeTax #RPGT #CKHT |

|

Starting from 1 January 2025, taxpayers are required to submit their Real Property Gains Tax (RPGT) Return Form via e-CKHT on the MyTax Portal as follows:

Step 1: Log in to MyTax Portal

Step 2: Select " ezHASiL Services > eCKHT > Choose the type of CKHT form and complete the relevant information "

Authorised lawyers and licensed tax agents appointed by taxpayers are permitted to access e-CKHT through the following mediums:

a) Licensed tax agents: TaeF System version 2.0; and

b) Lawyers: Lawyer Role on MyTax Portal

Click the link below for more information!

25/11/2024

[Tax A Minute] How to issue e-Invoice in the name of Sole Proprietorship?

#IncomeTax

#e-Invoice

| 25/11/2024 |

[Tax A Minute] How to issue e-Invoice in the name of Sole Proprietorship? #IncomeTax #e-Invoice |

|

Find below 3 steps to issue e-Invoice in the name of sole proprietorship:

Step 1: The business owner ensures the name and business information have been recorded in the LHDNM database.

(If the information has not been recorded, business owner must update the business information via e-Kemaskini on the MyTax Portal or submit to the LHDNM State Office)

Step 2: Business owners apply for the role as “Business Owner” through their respective MyTax Portal.

(Role application must be made for each sole proprietorship)

Step 3: Business owners can select relevant Business Name through the “Switch Taxpayer” function on the MyInvois Portal.

(Once the role application is approved, business owners can select the relevant business name)

Click the link below for more information!

21/11/2024

[Tax A Minute] e-Invoice Updates: Seller can scan QR Code to obtain buyer's info now!

#IncomeTax

#e-Invoice

#e-Invoicing

| 21/11/2024 |

[Tax A Minute] e-Invoice Updates: Seller can scan QR Code to obtain buyer's info now! #IncomeTax #e-Invoice #e-Invoicing |

|

Users can generate a QR Code of taxpayer information through the MyInvois Portal and Application to facilitate the process of data sharing for the purpose of issuing e-Invoices by the sellers.

Follow the simple steps as follows:

On Portal: Click View Taxpayer Profile > Click Generate QR Code > QR Code will be displayed to be saved

On Apps: Click View Taxpayer Profile > Profile > General Information > Click Generate QR Code > QR Code will be displayed to be saved

Seller can scan this QR code using the MyInvois App by:

New Document > Start > Buyer’s Information

Note: Please exercise caution when sharing the QR code. Only share it with the trusted third parties to protect your personal and sensitive information. LHDNM is not responsible for any unauthorized use or disclosure resulting from improper sharing of the QR code.

20/11/2024

[Tax A Minute] Updated RPGT Guideline from IRBM - Application to obtain approval for transfer of assets between companies in the same group to be treated as "No Gain No Loss"!

#IncomeTax

#RPGT

| 20/11/2024 |

[Tax A Minute] Updated RPGT Guideline from IRBM - Application to obtain approval for transfer of assets between companies in the same group to be treated as "No Gain No Loss"! #IncomeTax #RPGT |

|

The guideline explains the conditions, as well as the required information and documents to obtain approval for the transfer of assets between companies in the same group to be treated as ‘No Gain No Loss’ transaction under the following circumstances :-

1. an asset is transferred to bring about greater efficiency in operation for a consideration consisting of shares in the company or substantially of shares in the company and the balance of a money payment

2. an asset is transferred for any consideration in any scheme of reorganisation, reconstruction or amalgamation; or

3. an asset is distributed by a liquidator of a company and the liquidation of the company was made under a scheme of reorganisation, reconstruction or amalgamation

Note: The above guideline replaces the previous guideline dated 8 January 2015.

Please click the link below for more information!

19/11/2024

[Tax A Minute] The HRD Corp will request information from stakeholders as they implement e-Invoicing!

#IncomeTax

#e-Invoice

#E-InvoicingImplementation

| 19/11/2024 |

[Tax A Minute] The HRD Corp will request information from stakeholders as they implement e-Invoicing! #IncomeTax #e-Invoice #E-InvoicingImplementation |

|

With effect from 1 January 2025, the Human Resource Development Corporation (HRD Corp) will be implementing e-Invoicing.

Examples of information required from all stakeholders are as follows:

- Tax Identification Number

- Sales and Service (SST) Registration Number

- Malaysia Standard Industrial Classification (MSIC) Code

- IRBM Classification code

- … and other details

The implementation will impact all employers, trainers, training providers, and individuals.

Note: HRD Corp will communicate with all stakeholders on the information required through email and via their official website.

12/11/2024

[Tax A Minute] Form e-107D for 2% Withholding Tax for Commission Payments to Agents, Dealers or Distributors

#IncomeTax

| 12/11/2024 |

[Tax A Minute] Form e-107D for 2% Withholding Tax for Commission Payments to Agents, Dealers or Distributors #IncomeTax |

|

Starting from 1 January 2025, all the following transactions must be conducted online using e-107D:

- Submit Form CP107D

- Upload CP107D(2) attachment

- Generate bill number for Section 107D payment

- Payment using ByrHASiL

Submission must be made by the company director or representative.

MyTax > Log in > Select the role of director / representative > ezHasil Services > e-107D

07/11/2024

再见,今年你错过了, 就再等多一年吧!👋

#TaxSummit2024

| 07/11/2024 |

再见,今年你错过了, 就再等多一年吧!👋 #TaxSummit2024 |

|

税务是企业里的大事! 你不重视它, 你赚回来的钱就 bye bye 了 😐

没有额外收费的一对一咨询,你还在等什么?

Watch it here/ 点击观看 👉 https://fb.watch/vIdJ2FZcad/

Join us for the YYC Tax Summit 2024 on November 13th (English) or 14th (Chinese) and learn how to save on taxes!

11月13日 (英文) 或 14日 (中文), 来参加 YYC税务高峰会2024,教你如何省税!

[YYC TAX SUMMIT 2024] : https://bit.ly/40svowO

[YYC 税务高峰会 2024] : https://bit.ly/3YICBqr

06/11/2024

🤔 What Does the 2025 Budget Mean for You? 🤔 2025年财案对您意味着什么?

#TaxSummit2024

| 06/11/2024 |

🤔 What Does the 2025 Budget Mean for You? 🤔 2025年财案对您意味着什么? #TaxSummit2024 |

|

🔉 一起来听听 YYC 的税务专家们 对发布的2025年财案有什么看法!

Watch it here/ 点击观看 👉 https://fb.watch/vGWDBrI4VU/

Join us for the YYC Tax Summit 2024 on November 13th (English) or 14th (Chinese) and learn how to save on taxes!

11月13日 (英文) 或 14日 (中文), 来参加 YYC税务高峰会2024,教你如何省税!

[YYC TAX SUMMIT 2024] : https://bit.ly/40svowO

[YYC 税务高峰会 2024] : https://bit.ly/3YICBqr

04/11/2024

[Tax A Minute] Capital Allowance on Software Development Cost / ICT Gazetted!

#IncomeTax

#CapitalAllowance

| 04/11/2024 |

[Tax A Minute] Capital Allowance on Software Development Cost / ICT Gazetted! #IncomeTax #CapitalAllowance |

|

Taxpayers are able to fully claim capital allowance (CA) within 3 years with rates below when they incur expenses on Software Development cost / Information and Communication Technology (ICT) equipment.

- Initial allowance (IA): 40%

- Annual allowance (AA): 20%

Eligible for CA:

- Development cost for customised computer software

- Any ICT specified in the Schedule:

- Access control system

- Bar code equipment

- Computer and component

- Storage

- ...and more! (Refer to the order for the full list)

Please click the link for more information!

04/11/2024

3 Common Pain Points in e-Invoicing Implementation in Malaysia

| 04/11/2024 |

3 Common Pain Points in e-Invoicing Implementation in Malaysia |

|

🤯 Regulatory Complexity - Understanding and adhering to the regulations set by the IRB can be a daunting task.

🤯 Technological Challenges – Integrating e-invoicing systems with existing ERP and accounting systems can be complex and time-consuming.

🤯 Resistance to Change – The e-invoicing implementation can meet resistance from employees who may be hesitant to adopt new ways of working.

Join Us at YYC Tax Summit 2024 as there will be a sharing session about this!

💥Exclusively for taxPOD subscribers only 💥

Click here to join this fruitful session at the lowest price of RM 498! (OP: RM 998)

👉 https://bit.ly/40svowO

02/11/2024

Curious About Malaysia’s New 2% Dividend Tax? Discover the Impact at YYC Tax Summit 2024!

| 02/11/2024 |

Curious About Malaysia’s New 2% Dividend Tax? Discover the Impact at YYC Tax Summit 2024! |

|

With Malaysia’s recent Budget 2025 announcement, a 2% tax on dividend income exceeding RM100,000 is set to take effect in the coming year. This change has raised questions about how it might impact investors, high-income earners, and the broader economy. But understanding its full implications requires in-depth knowledge of tax strategy and expert insights on policy shifts.

Potential Implications of 2% Dividend Tax

🟢 Double Taxation Concerns – For individual shareholders, dividend income from already-taxed corporate profits may feel like double taxation, potentially discouraging large dividend payouts.

🟢 Reduced after-tax returns for high-income earners - Investors who receive significant dividend income will see a reduction in their after-tax returns.

🟢 Potential impact on investment decisions – The new tax may influence investment decisions, as investors may consider alternative investment options with lower tax implications.

Join Us at YYC Tax Summit 2024 as the CEO of YYC and Finance Expert, Datin Shin will tell you more about the who will be affected by the new tax and potential changes to dividend income planning and more!

💥Exclusively for taxPOD subscribers only 💥

Click here to join this fruitful session at the lowest price of RM 498! (OP: RM 998)

👉 https://bit.ly/40svowO

02/11/2024

公司还有大量 retained earnings 和 cash? 想发股息又怕多交税?

| 02/11/2024 |

公司还有大量 retained earnings 和 cash? 想发股息又怕多交税? |

|

⚠️⚠️2025年股息税来了!公司还有大量 retained earnings 和 cash? 想发股息又怕多交税?

点击以下链接了解更多详情吧❗️🤩

点击观看 👉 https://fb.watch/vAp8tD17V1/

快来参加我们的《YYC税务高峰会 2024》!手把手教你如何应对新税制,还有免费赠送的实用工具!✅

[YYC TAX SUMMIT 2024] : https://bit.ly/40svowO

[YYC 税务高峰会 2024] : https://bit.ly/3YICBqr

02/11/2024

明年开始,个人股息收入超过10万就要缴纳 2%的股息税!

| 02/11/2024 |

明年开始,个人股息收入超过10万就要缴纳 2%的股息税! |

|

老板们,注意啦! 明年开始,个人股息收入超过10万就要缴纳 2%的股息税。想了解如何应对?

点击以下链接了解更多详情吧❗️🤩

点击观看 👉 https://fb.watch/vAp4_FC6Kh/

11月13日 (英文) 或 14日 (中文), 来参加 YYC税务高峰会2024,教你如何省税!

[YYC TAX SUMMIT 2024] : https://bit.ly/40svowO

[YYC 税务高峰会 2024] : https://bit.ly/3YICBqr

01/11/2024

[Tax A Minute] Imposition of 2% Tax on Dividends Received by Individual Shareholders

#IncomeTax

#DividendTax

| 01/11/2024 |

[Tax A Minute] Imposition of 2% Tax on Dividends Received by Individual Shareholders #IncomeTax #DividendTax |

|

To broaden the tax base for individuals, Budget 2025 proposes the introduction of a 2% Dividend Tax, effective from YA 2025, as outlined below:

- Scope of taxation: This applies to dividend income received by individual shareholders, including residents, non-residents, and individuals who hold shares through nominees.

- Threshold: The tax applies to annual dividend income exceeding RM100,000.

However, certain exemptions will apply, including dividend income from abroad and distributions received from the EPF or unit trusts.

Join our Tax Summit to gain insights into the 2% Dividend Tax! We look forward to seeing you there!

Registration Link:

Tax Summit (EN) – https://bit.ly/40svowO

Tax Summit (CN) – https://bit.ly/3YICBqr

29/10/2024

[Tax A Minute] Additional deductions on remuneration paid to senior citizen / ex-convict / ex-drug dependant

#IncomeTax

#Deduction

| 29/10/2024 |

[Tax A Minute] Additional deductions on remuneration paid to senior citizen / ex-convict / ex-drug dependant #IncomeTax #Deduction |

|

Employers will have an additional 100% tax deduction when they hire an employee, who is a citizen and resident in Malaysia, amongst the following:

1. Senior citizen who is 60 years old and above;

2. An ex-convict who had served his sentence of imprisonment (with written confirmation);

3. A parolee (with written confirmation);

4. A supervised person who is a prisoner directed to work at such labour (with written confirmation); or

5. An ex-drug dependant (with written confirmation).

Subject to the following conditions:

1. The employee is employed on a full-time basis;

2. The remuneration of the employee does not exceed RM4,000;

3. The employer and employee are not the same person; and

4. The employer is not a relative of the employee.

The additional deduction shall have effect from the year of assessment 2019 until the year of assessment 2025.

Please click the link below for more information!

25/10/2024

[Tax A Minute] MyInvois App is available now!

#IncomeTax

#e-Invoice

#MyInvois

| 25/10/2024 |

[Tax A Minute] MyInvois App is available now! #IncomeTax #e-Invoice #MyInvois |

|

Taxpayers can now use the MyInvois Application on smartphones by downloading from the operating system platforms with the minimum requirements as below:

- iOS users: iOS version 16.0 version and above

- Android users: Android version 13 (API 33) and above

- Huawei users: EMUI version 8.0 and above

To access and manage e-Invoices through the MyInvois App, users must login to MyInvois Portal to complete the first time login process first.

The MyInvois App offers key features similar to the MyInvois Portal, including:

- Profile Management for Users, Taxpayers (Companies/ Organizations), Representatives, ERP Systems, and Intermediaries; and

- Document Management including Submission, Review, Rejection, Cancellation, and Document Printing.

Please click the link below for more information!

21/10/2024

😱 Attention, Business Owners! Zen explains the 3️⃣ KEY TAX MEASURES in the Budget 2025 for you❗️

#Budget2025

| 21/10/2024 |

😱 Attention, Business Owners! Zen explains the 3️⃣ KEY TAX MEASURES in the Budget 2025 for you❗️ #Budget2025 |

|

💻 Accelerated Capital Allowance for ICT Equipment

🧔♀️ Additional 50% tax deduction for hiring women returning to the work

⏰ Additional 50% tax deduction for flexible work arrangements

Click the link below for more details!

21/10/2024

😱 Taxpayers, do you know what was announced in the 2025 Budget❓

#Budget2025

| 21/10/2024 |

😱 Taxpayers, do you know what was announced in the 2025 Budget❓ #Budget2025 |

|

💡Tax on your dividend income❓

💡Increment in medical and education insurance tax relief❓❗️

💡Loan interest relief for first-time homebuyers❓❗️

Watch the video to know more! 🤩

21/10/2024

[Tax A Minute] MyInvois Portal Enhanced!

#IncomeTax

#MyInvois

| 21/10/2024 |

[Tax A Minute] MyInvois Portal Enhanced! #IncomeTax #MyInvois |

|

The MyInvois Portal has been enhanced as follows:

Enhanced Document Search Capabilities

- Search for recently submitted or received documents

- Search for documents using specific key values based on user’s interest

e-Invoice Visual Representation Templates Management

- Customize visual representation templates for printed documents such as logo position, specific headers and footers as well as Supplier and Buyer details to be presented

Document Notification

- Additional type of document notifications including document received, validated, rejected and cancelled, etc.

Drafting and Copying Documents Functionality

- Save document data as draft on a regular basis to ensure entered data is not lost

- Draft documents are incomplete documents to be completed later

- Function to copy previous document to draft new document

19/10/2024

😱 企业家们, 看过来!Zen 为您解释2025年财政预算案3️⃣大税务重点 ❗️

#budget

#2025

| 19/10/2024 |

😱 企业家们, 看过来!Zen 为您解释2025年财政预算案3️⃣大税务重点 ❗️ #budget #2025 |

|

💻 资讯与通讯科技器材(资本津贴)

🧔♀️ 重返职场的女性们 - 额外50%的税务扣除

⏰ 弹性工作安排 - 额外50%的税务扣除

点击以下链接了解更多详情吧❗️🤩

19/10/2024

😱 纳税人,你们知道2025年财政预算案到底宣布了什么吗❓

| 19/10/2024 |

😱 纳税人,你们知道2025年财政预算案到底宣布了什么吗❓ |

|

15/10/2024

[Tax A Minute] Tax Incentive for Forest City Special Financial Zone - Announced!

#IncomeTax

#TaxIncentive

#ForestCity

| 15/10/2024 |

[Tax A Minute] Tax Incentive for Forest City Special Financial Zone - Announced! #IncomeTax #TaxIncentive #ForestCity |

|

The Government is pleased to announce a competitive package of incentives to make Forest City a magnet for international capital:

1. Corporate Tax Rate: Between 0% to 5%

2. Individual Tax Rate: 15% income tax rate for knowledge workers and Malaysians who choose to work here

3. Family Office: 0% tax rate

4. Special Tax Rate of 5%: Hub for Financial Global Business Services / Fintech / Foreign Payment System Operators

5. Banking Institution / Insurance / Capital Market Intermediaries / Financial Sector: Special deduction, enhanced allowance, exemption

Click below for more details!

14/10/2024

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in October 2024?

#IncomeTax

| 14/10/2024 |

[Tax A Minute] Upcoming Submission Deadline: What are the key dates for tax in October 2024? #IncomeTax |

|

There are several submission deadlines that employers should be aware of. Let's take a look at what will be due by the end of October 2024:-

✅6th month revision of tax estimates for companies with April year-end

✅9th month revision of tax estimates for companies with January year-end

✅11th month revision of tax estimates for companies with November year-end

✅Statutory filing of 2023 tax returns for companies with March year-end

✅Maintenance of transfer pricing documentation for companies with March year-end

Don’t miss the deadline!

09/10/2024

[Tax A Minute] MyInvois Portal’s Maintenance Notice

#IncomeTax

| 09/10/2024 |

[Tax A Minute] MyInvois Portal’s Maintenance Notice #IncomeTax |

|

Kindly be informed that the MyInvois Portal is under maintenance for the period below:

Prepod Environment

Date: 10 October 2024 (Thursday)

Time: 8:00pm to 12:00 am

Production Environment

Date: 12 October 2024 (Saturday)

Time: 12:00am to 3:00am

Thank you for your patience and cooperation!

08/10/2024

[Tax A Minute] A New Operational Guideline is here!

#IncomeTax

#TCC

| 08/10/2024 |

[Tax A Minute] A New Operational Guideline is here! #IncomeTax #TCC |

|

The Inland Revenue Board (HASiL) has published Operational Guideline 4/2024 that provides explanation and information on the Tax Compliance Certificate (TCC).

The guideline explains:

1. What is a TCC?

2. Why is TCC needed?

3. How to check whether you have a TCC?

4. Qualifications to get a TCC

5. Validity of a TCC

In short, if a business or an individual applying for government jobs or contracts, make sure the TCC is obtained to be eligible.

Please click on the link below for more information!

07/10/2024

[Tax A Minute] New e-Invoice updates are here!

#IncomeTax

#e-Invoice

| 07/10/2024 |

[Tax A Minute] New e-Invoice updates are here! #IncomeTax #e-Invoice |

|

The following updates are based on:

- E-Invoice General Guideline (updated on 4 October 2024)

- E-Invoice Specific Guideline (updated on 4 October 2024)

- E-Invoice General Frequently Asked Questions (updated on 4 October 2024)

The updates involved are as follows:

1. Exemptions from implementing e-Invoice.

2. The buyer details for the exempted persons.

3. Applicability of e-Invoice implementation in Malaysia

4. Import or export of goods or services

5. Detailed explanation on e-Invoice treatment for MSME.

6. E-Invoice treatment during interim relaxation period.

Please click the link below for more information!

04/10/2024

[Tax A Minute] e-Invoice Implementation date has been gazetted!

#IncomeTax

#e-Invoice

| 04/10/2024 |

[Tax A Minute] e-Invoice Implementation date has been gazetted! #IncomeTax #e-Invoice |

|

The implementation date for e-Invoice has been gazetted on 30 September 2024.

Any person who carries out a transaction in respect of any goods sold or service performed shall issue an electronic invoice in relation to their annual sales.

The Federal Gazette also includes the following:

- The determination of annual sales

- The calculation where there is a change of accounting period

- The particulars in e-Invoice

- The non-application of e-Invoice

Please stay tuned for our monthly tax update class for more details!

30/09/2024

[Tax A Minute] FAQ for e-PCB Plus is now available!

#IncomeTax

#e-PCB

#e-PCBPlus

| 30/09/2024 |

[Tax A Minute] FAQ for e-PCB Plus is now available! #IncomeTax #e-PCB #e-PCBPlus |

|

The Inland Revenue Board of Malaysia (HASiL) has published a frequently asked questions (FAQs) on the new e-PCB Plus on MyTax!

The FAQs included the following:

- What’s the differences between the existing PCB system (e-PCB/ e-CP39/ e-Data PCB) compared to e-PCB Plus?;

- Will e-PCB Plus have all the information from the existing PCB system?;

- What are the preparations required for director / employer before using e-PCB Plus?;

- How to select the employer’s representative in e-PCB Plus?;

- How to access the e-PCB Plus system?;

- What information is required in the e-PCB Plus system?; and etc.

Users are required to log in to their MyTax account to access the FAQ.

Please click the link below to log in!

26/09/2024

[Tax A Minute] MyInvois Portal’s Maintenance Notice

#IncomeTax

#MyInvois

| 26/09/2024 |

[Tax A Minute] MyInvois Portal’s Maintenance Notice #IncomeTax #MyInvois |

|

Kindly be informed that the MyInvois Portal is under maintenance for the period below:

Prepod Environment

Date: 27 September 2024 (Friday)

Time: 8:00pm to 12:00 am

Production Environment

Date: 28 September 2024 (Saturday)

Time: 12:00am to 3:00am

Thank you for your patience and cooperation!

24/09/2024

[Tax A Minute] The SST Public Ruling has been amended and is now available!

#IncomeTax

#SST

| 24/09/2024 |

[Tax A Minute] The SST Public Ruling has been amended and is now available! #IncomeTax #SST |

|

The Royal Malaysian Customs Department (RMCD) has issued the following:

- Public Ruling No. 02/2024 (Amendment) (No.2) 2024 - Manufacturing Aids and Cleanroom Equipment

The manufacturing aids listed in Appendix 1 of Public Ruling No. 02/2024 have increased from 242 items to 246 items as follows:-

243. Blister Pack

244. Forming Fabrics

245.Press Felts

246. Dryer Fabrics

This PR is effective from 20 September 2024.

Please click the link below for more information!

23/09/2024

[Tax A Minute] e-PCB Plus Phase 1 is here!

#IncomeTax

#MyTax

#PCB

#e-PCB

| 23/09/2024 |

[Tax A Minute] e-PCB Plus Phase 1 is here! #IncomeTax #MyTax #PCB #e-PCB |

|

e-PCB Plus will replace the existing PCB system (e-PCB/e-CP39/e-Data PCB) using a single platform through the MyTax portal. e-PCB Plus Phase 1 will be available on 24 September 2024.

Phase 1:

- Registration of the role of Employer / Employer Representative / PCB Administrator in MyTax

- Registration of the role of Administrator Representative in e-PCB Plus

- Update of employer/employee details in e-PCB Plus

Users need to log in to the MyTax portal using their individual ID & Password and select the related role to access e-PCB Plus. Please refer to the User Manual for more information.

Note: The existing PCB system will continue to function as usual until the announcement of its closure.

20/09/2024

[Tax A Minute] PRS Withdrawal is Taxable?

#IncomeTax

#PRS

| 20/09/2024 |

[Tax A Minute] PRS Withdrawal is Taxable? #IncomeTax #PRS |

|

As we enter Q4 of 2024, it is important to take note of any available tax relief. One such option is contributing to the PRS. However, have you ever wondered if the withdrawal of contributions from the PRS is taxable?

Contributions to a PRS fund will be split and maintained in sub-accounts A (can be withdrawn only upon reaching the retirement age of 55 years old) and B (can be withdrawn only once a year).

Contributions in sub-account A and/or sub-account B can be withdrawn at any time for the following reasons:

- Permanent total disablement (A & B)

- Serious disease (A & B)

- Mental disability (A & B)

- Death (A & B)

- Permanently leaving Malaysia (A & B)

- Healthcare (B only)

- Housing (B only)

Except for the reasons stated above, withholding tax (final tax) at the rate of 8% will be imposed for withdrawal before reaching the age of 55.

Please click the link below for more information!

18/09/2024

[Tax A Minute] Penalty and Surcharge Remission Incentives for Year 2024

#IncomeTax

#ServiceTax

#RMCD

#SalesTax

| 18/09/2024 |

[Tax A Minute] Penalty and Surcharge Remission Incentives for Year 2024 #IncomeTax #ServiceTax #RMCD #SalesTax |

|

Eligibility

- Goods and Services Tax / Tourism Tax / Sales Tax / Service Tax / Departure Levy

- Bill of Demand (BOD) for taxable periods ended on or before 31 December 2023.

- Payments must be made between 26 August 2024 and 31 December 2024.

Arrears Category and Rate of Incentive

Please click the link below for more information!

13/09/2024

[Tax A Minute] Guide to Filling a Notice of Appeal (Form Q) is out!

#IncomeTax

#Appeal

| 13/09/2024 |

[Tax A Minute] Guide to Filling a Notice of Appeal (Form Q) is out! #IncomeTax #Appeal |

|

The Inland Revenue Board of Malaysia (HASiL) has published a guide on how to fill out a written notice of appeal (Form Q) for taxpayers who are aggrieved by an assessment raised by HASiL based on the Form JA they received.

Please click here for the full guide!

12/09/2024

[Tax A Minute] Notification Regarding the New Function of e-SPC

#IncomeTax

#e-SPC

| 12/09/2024 |